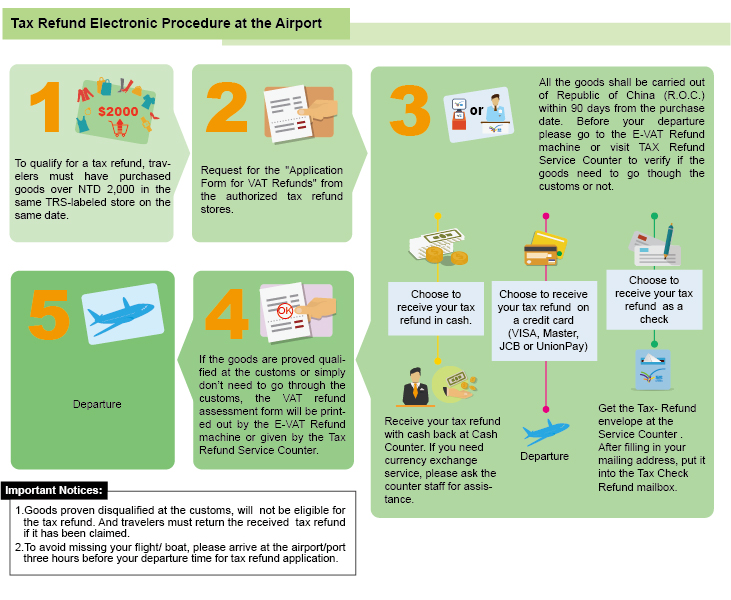

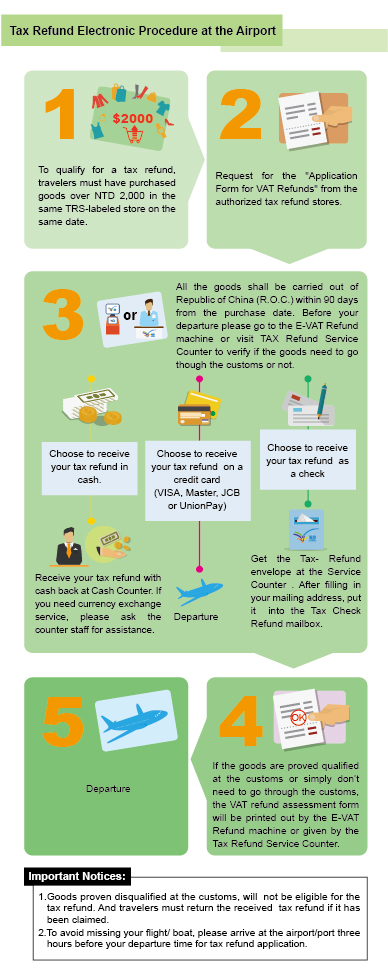

Procedures of Claiming E-VAT Refund

Please arrive at the airport/port three hours before your departure time and go to the E-VAT refund machine or visit VAT refund service counter for tax refund application. Before your luggage check-in, please take your passport and VAT Refund Claim Form to the E-VAT refund machine or VAT refund service counter to scan your passport and the tax refund receipts. The tax refund system will instruct you if your goods need to be examined by Customs or not. You can go to the E-VAT refund machine or visit VAT refund service counter for tax refund application if your goods do not need to be examined.

-

If your goods need to go through the Customs, the machine will print out a checklist. Please visit the customs counter with the following documents and the checklist:

-

The checklist.(printed by the E-VAT Refund Machine)

-

“Application Form for VAT Refunds”.

-

Personal documents (passport, travel documents, exit & entry permit or temporary entry permit

-

The invoices or E-invoices certificates noted with “tax-refundable goods” or “the last 4 digits of your passport number”

-

The goods you purchased.

-

-

Tax refund payment method.

You could choose to receive your tax refund through cash, credit cards (VISA, MASTER and JCB), account at UnionPay or check. If you choose to receive the refund “in cash”, please obtain the

receipt “VAT refund application Form” printed out by the machine or given by the Service Counter and go to the designated banks or cash counters located at departure airports/ports for your tax refund. -

ATTENTION for those who use their credit cards or checks for tax refund payment.

If you choose to receive the refund on credit cards or as checks, you may apply for the refund by transferring it to your credit card account (VISA, MASTER, JCB and UnionPay) at the E-VAT refund machine or VAT refund service counter, or you may also apply for a refund as a check at the VAT refund service counter.